Articles

There is no elegance period in case your recipient from a POD membership passes away. Most of the time, insurance rates to your deposits will be smaller quickly. From the unlikely knowledge away from a financial incapacity, the newest FDIC acts quickly to protect insured places from the arranging a great product sales to help you a healthy bank, otherwise by paying depositors individually for their deposit profile to the covered limitation. Including, a mortgage servicer gathers in one,100000 various other individuals its monthly home loan repayments away from $2,000 (P&I) and you may urban centers the money to the home financing maintenance account. The brand new $dos,000,one hundred thousand aggregate equilibrium from the home loan upkeep account is completely covered to the financial while the per borrower’s fee of $dos,one hundred thousand (P&I) is actually covered on their own for approximately $250,100000. The new account is actually covered to the mortgage buyers for the collective balance paid to your membership from the individuals, or in acquisition in order to meet consumers’ principal or attention debt to the lender, around $250,one hundred thousand for each mortgagor.

- Since the FDIC’s circulate is intended to make insurance regulations to have believe profile easier, it may force certain depositors over FDIC constraints, according to Ken Tumin, inventor of DepositAccounts and you may elder community analyst in the LendingTree.

- This is not a means to rating an immediate deposit of your taxation refund for the bank account.

- The newest Share Insurance rates Financing in addition to individually handles IRA and you can KEOGH retirement accounts up to $250,100000.

- Flower Co. selected for taking the newest accredited small company payroll tax credit to have broadening search points for the Setting 6765.

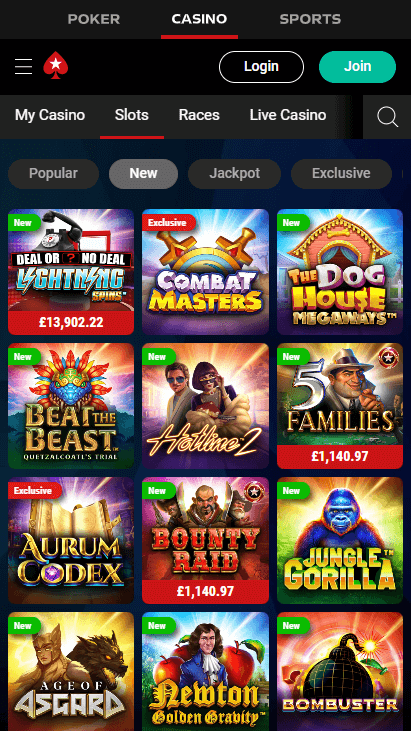

Microgaming games list | step 1 Maturity Recommendations

Of several forms and you will tips talked about in these tips have Foreign-language-language models designed for companies and you will staff. Some situations were Form 941 (sp), Setting 944 (sp), Function SS-4 (sp), Mode W-cuatro (sp), and you will Mode W-9 (sp). Even if such recommendations don’t resource Foreign language-words variations and you will tips inside the per for example this can be found, you can view Bar. 15 (sp) or check out Internal revenue service.gov/SpanishForms to choose when the a good Foreign-language-words version can be obtained. I do that to ensure whenever we send your real fee, we posting it to your proper checking account.

Somebody could possibly get still purchase, manage, and you will redeem electronic EE or I Ties safely because of your own TreasuryDirect account. Federal Team Health benefits (FEHB) System qualifies since the minimum extremely important publicity (MEC) and you may suits the patient Protection and you will Sensible Worry Operate. Voluntary Annuity Allotments is actually withholdings which can be withheld from your monthly annuity benefit. Federal and state Income tax and you will Monetary Allotments is actually samples of Volunteer Annuity Allotments. The brand new election making a keen allowance otherwise withholding change will likely be generated on the web which have Features On line.

Who Must File Function 941?

A job scams have fun with tempting, and hard-to-find, lures to target somebody who’ve been unemployed. Some fraudsters get a slower strategy which have interviews and a valid-appearing process. They then assemble information that is personal out of your a career versions, or tell you straight to buy devices otherwise degree. On the web purchase frauds remain one of the riskiest types away from scams, depending on the Bbb. Even if average losings were apparently reduced in the $one hundred, over 40% of your scams claimed for the Bbb have been on line pick frauds as well as over 80% of men and women statement falling to the scam.

Part 6011 means one to deliver the microgaming games list requested guidance should your taxation applies to you. Point 6109 needs one give the personality number. You’re not needed to own suggestions questioned for the an application which is susceptible to the fresh Paperwork Reduction Operate except if the form displays a valid OMB control matter. Books otherwise details based on a form otherwise the instructions need to be employed as long as its articles becomes topic inside the the brand new administration of any Interior Revenue legislation.

Are the full government taxation withheld of earnings, information, or other settlement (line 3); the complete personal security and you will Medicare fees before alterations (range 5e); and you can one tax due less than a part 3121(q) Notice and you can Demand (line 5f). If you’re also a governmental company, wages you have to pay aren’t instantly excused out of public defense and you may Medicare taxation. Your workers could be covered by laws or because of the an excellent voluntary Section 218 Arrangement on the SSA. For many who permanently go out of organization or stop investing earnings on the team, you need to document a last return. To share with the brand new Irs one Form 941 to possess a specific one-fourth is the latest return, browse the container on the web 17 and go into the finally go out your repaid wages.

SoFi will pay recognized APYs to the both the savings and you may checking servings of your balance (with discounts balances generating the highest interest) and offers extra FDIC insurance as much as $3 million. You could be eligible for zero-percentage overdraft coverage and you can early paycheck receipt. You’ll secure a substantial give to the all stability without the need to satisfy any conditions otherwise shell out of numerous costs. Which makes that it membership helpful for someone looking to playground bucks to have a future you want (for example Xmas presents or an automobile advance payment) and you will make use of well liked customer support.

Amount of costs-of-lifestyle improve you are going to receive

Checking account incentives are typically available in order to the newest examining otherwise checking account proprietors. The holidays are particularly brings a rise from frauds. Discover more about preferred type of frauds regarding the CFPB’s online resources. Users can be fill out complaints from the borrowing products and you may features, as well as frauds for the percentage networks, by visiting the fresh CFPB’s web site otherwise by calling (855) 411-CFPB (2372). – Now, the consumer Economic Defense Bureau (CFPB) sued the new operator of Zelle and you may about three of the nation’s largest financial institutions to own neglecting to cover consumers out of widespread ripoff to the America’s most accessible fellow-to-fellow fee system.

See Terminating a business from the Standard Instructions to possess Variations W-2 and you may W-step three to own information regarding prior to dates to the expedited decorating and you will submitting from Versions W-2 whenever a last Form 941 is registered. Whenever a couple of organizations blend, the new carried on business need file a return for the one-fourth within the which the transform occurred and also the almost every other firm is always to file a last get back. For many who promote otherwise import your company within the quarter, both you and the brand new proprietor have to per file a questionnaire 941 for the quarter where transfer happened. If you learn a blunder to your an earlier recorded Mode 941, or you if you don’t need amend an earlier filed Form 941, make the correction using Form 941-X. To learn more, comprehend the Recommendations to possess Setting 941-X, part 13 away from Club. The new Medicare income tax speed are step one.45% for each and every for the personnel and you may company, undamaged out of 2024.

To discover the bonus, the new account need to nevertheless be open. Yes, you need to unlock among the eligible membership by Sep 29, 2025. Dollars App is a well-known target certainly one of fraudsters looking to discount private information or funds from naive pages.

One another provides deserves, and it’ll extremely rely on in which you’re also in the on your own economic journey. We believe individuals can make financial conclusion with rely on. Even though our very own website doesn’t function all company or monetary tool on the market, we’re satisfied that the guidance you can expect, all the information we provide and also the products i manage are purpose, independent, quick — and free.

How it calculator works This is a simple attention calculator. Performance range from the true interest gained for the Westpac issues due to differences in the new calculation tips put. The brand new CFPB’s suit aims to halt illegal carry out, get redress to own hurt people, and obtain a municipal currency punishment, which would be distributed for the CFPB’s sufferers relief fund, and you may safer almost every other compatible rescue. Beneath the Individual Financial Protection Act, the brand new CFPB contains the authority to take action facing associations breaking consumer financial protection legislation, in addition to engaging in unjust, deceptive, otherwise abusive serves and you may strategies.